Note: Hourly compensation is of production/nonsupervisory workers in the private sector and productivity is for the total economy.

Source: Author’s analysis of unpublished total economy data from Bureau of Labor Statistics, Labor Productivity and Costs program and Bureau of Economic Analysis, National Income and Product Accounts public data series

—

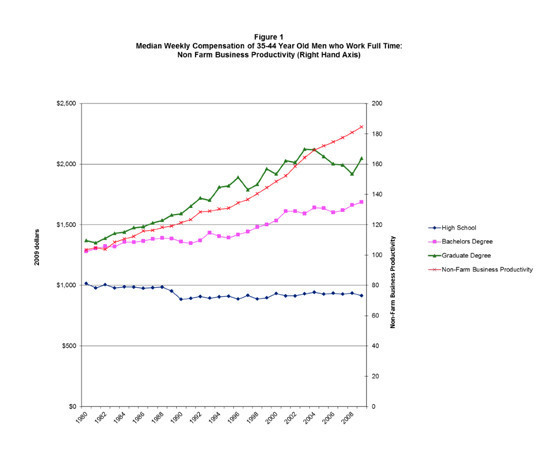

THE BOTTOM (high school graduates):

This graph highlights the growing disparity between wages paid and productivity for different educational levels (which we will use as proxies for societal classes). There are a number of explanations for this decoupling. One explanation is the decline of labor union participation due to regulatory changes and pressure from globalization. Another explanation is that as technology has advanced, it has become and increasingly important factor of production; businesses are opting to spend a larger portion of their revenues on machinery as opposed to workers.

This Monday I observed a roundtable at the U.N.– “The Threat of Growing Inequalities”–where one of the speakers raised this point. Taking home a “smaller piece of the pie”, those at the bottom are able to buy less political influence, which leads to weakened labor rights and neglected falling real minimum wages. Economic forces enable those at the top to rig to laws in their favor, further exacerbating inequality–this is the political economy explanation of rising inequality. This explanation hits on another divisive element of contemporary American society, the different legal system experienced based on ones wealth.

Whatever the reason (or as is often the case in real-world economic analysis, combination of reasons), this phenomenon obviously contributes to increasing inequality. How bad is inequality today? The Stanford Center for the Study of Poverty and Inequality has 20 graphs which tell much of the story, while Politifact has compiled a number of inequality related “fact-checks”.

It is heartening to see grassroots minimum-wage movements emerge, spanning many industries (and worldwide, many countries), led by people who are willing to take a stand through collective action. These people are willing to risk the wrath of vengeful corporate executives for economic justice. However, it will take a concerted effort by well intended politicians, independent media outlets (I try to do my part), and progressive judges / competent public defenders to capitalize on this grassroots activism if meaningful progress is to be made on the inequality front.

—

THE TOP (“the .1%” is not represented in the graph above):

What is going on at the bottom of the economic pyramid is only part of the inequality story. The meteoric rise of top earners incomes increases inequality; economic growth is important, but how evenly it is distributed also matters. Again here we see a decoupling of wages and productivity in the other direction (much greater compensation than productivity; in fact, one could argue short-sighted investments result in negative productivity for the economy as a whole, while at the sane time lead to huge rewards for those carrying them out). A micro-example of this adverse relationship, described by former derivatives trader Sam Polk, as “wealth addiction”, is highlighted in a recent NYT opinion piece:

IN my last year on Wall Street my bonus was $3.6 million — and I was angry because it wasn’t big enough. I was 30 years old, had no children to raise, no debts to pay, no philanthropic goal in mind. I wanted more money for exactly the same reason an alcoholic needs another drink: I was addicted.

I’d always looked enviously at the people who earned more than I did; now, for the first time, I was embarrassed for them, and for me. I made in a single year more than my mom made her whole life. I knew that wasn’t fair; that wasn’t right. Yes, I was sharp, good with numbers. I had marketable talents. But in the end I didn’t really do anything. I was a derivatives trader, and it occurred to me the world would hardly change at all if credit derivatives ceased to exist. Not so nurse practitioners. What had seemed normal now seemed deeply distorted.

DESPITE my realizations, it was incredibly difficult to leave. I was terrified of running out of money and of forgoing future bonuses. More than anything, I was afraid that five or 10 years down the road, I’d feel like an idiot for walking away from my one chance to be really important. What made it harder was that people thought I was crazy for thinking about leaving. In 2010, in a final paroxysm of my withering addiction, I demanded $8 million instead of $3.6 million. My bosses said they’d raise my bonus if I agreed to stay several more years. Instead, I walked away.

The first year was really hard. I went through what I can only describe as withdrawal — waking up at nights panicked about running out of money, scouring the headlines to see which of my old co-workers had gotten promoted. Over time it got easier — I started to realize that I had enough money, and if I needed to make more, I could. But my wealth addiction still hasn’t gone completely away. Sometimes I still buy lottery tickets.

Wealth addiction was described by the late sociologist and playwright Philip Slater in a 1980 book, but addiction researchers have paid the concept little attention. Like alcoholics driving drunk, wealth addiction imperils everyone. Wealth addicts are, more than anybody, specifically responsible for the ever widening rift that is tearing apart our once great country. Wealth addicts are responsible for the vast and toxic disparity between the rich and the poor and the annihilation of the middle class. Only a wealth addict would feel justified in receiving $14 million in compensation — including an $8.5 million bonus — as the McDonald’s C.E.O., Don Thompson, did in 2012, while his company then published a brochure for its work force on how to survive on their low wages. Only a wealth addict would earn hundreds of millions as a hedge-fund manager, and then lobby to maintain a tax loophole that gave him a lower tax rate than his secretary.

I see Wall Street’s mantra — “We’re smarter and work harder than everyone else, so we deserve all this money” — for what it is: the rationalization of addicts. From a distance I can see what I couldn’t see then — that Wall Street is a toxic culture that encourages the grandiosity of people who are desperately trying to feel powerful.

I was lucky. My experience with drugs and alcohol allowed me to recognize my pursuit of wealth as an addiction. The years of work I did with my counselor helped me heal the parts of myself that felt damaged and inadequate, so that I had enough of a core sense of self to walk away.

Dozens of different types of 12-step support groups — including Clutterers Anonymous and On-Line Gamers Anonymous — exist to help addicts of various types, yet there is no Wealth Addicts Anonymous. Why not? Because our culture supports and even lauds the addiction. Look at the magazine covers in any newsstand, plastered with the faces of celebrities and C.E.O.’s; the super-rich are our cultural gods. I hope we all confront our part in enabling wealth addicts to exert so much influence over our country.

This is a powerful piece, an inside voice admitting that derivatives traders “don’t really do anything”, and that an insatiable “wealth addiction” (and the political clout it buys) drives a widening income gap in this country. The idea that much investment “doesn’t really do anything”, that it is speculative rather than true investment, is not a new concept. In fact, the concept was laid out eloquently by John Maynard Keynes in “The General Theory of Employment, Interest, and Money“:

It happens, however, that the energies and skill of the professional investor and speculator are mainly occupied otherwise. For most of these persons are, in fact, largely concerned, not with making superior long-term forecasts of the probable yield of an investment over its whole life, but with foreseeing changes in the conventional basis of valuation a short time ahead of the general public. They are concerned, not with what an investment is really worth to a man who buys it “for keeps”, but with what the market will value it at, under the influence of mass psychology, three months or a year hence.

Of the maxims of orthodox finance none, surely, is more anti-social than the fetish of liquidity, the doctrine that it is a positive virtue on the part of investment institutions to concentrate their resources upon the holding of “liquid” securities. It forgets that there is no such thing as liquidity of investment for the community as a whole. The social object of skilled investment should be to defeat the dark forces of time and ignorance which envelop our future. The actual, private object of the most skilled investment to-day is “to beat the gun”, as the Americans so well express it, to outwit the crowd, and to pass the bad, or depreciating, half-crown to the other fellow.”

This was written in 1936 in the context of post-Great Depression financial regulation, long before technological changes such as the internet and mass-deregulation created a risk-seeking “too-big-to-fail” financial sector which nearly destroyed the global economy in 2008. One can imagine what Keynes would have to say about the financial sector–and the inadequate regulatory response to the Great Recession–we experience today!

The top his risen due with the help of financial deregulation, enabling a “wealth addiction” by canonizing those selfish (or at best ignorant) enough to pursue such ends. This, coupled with the bottoming out of the lower end of the economic pyramid, leads to gross inequality. Inequality distorts our legal and political system, which leads to self-perpetuating social immobility; those at the top stay at the top (and continue rising), while those at the bottom stay at the bottom (an inter-generational poverty trap).

But how could we let this happen to America, once a “beacon of hope”? Wouldn’t our democratic system have stopped this from happening?

—

THE MIDDLE (bachelors and graduate degree earners):

It is indeed perplexing how we got into this mess, given America’s democratic system. Part of the explanation is that we canonize the rich–we want to be them, we don’t want to regulate them. We also vilify the poor–they are lazy, undeserving, and are responsible for the majority of anti-social behavior (crime, drug use, etc.). “We” here is the middle class, the last faction of American society where social mobility and meritocracy exists (to a certain extent).

Middle class families can afford the necessities needed for “equality of opportunity”, even if they cannot afford great luxuries. They earn college degrees and go on to make living wages. These workers still see a connection between productivity and compensation. An income of $50,000/yr is probably related to the amount you produce. Perform well and there is a promotion in it for you; you may even “make it to the top”!

To paraphrase John Steinbeck: “Socialism never took root in America because the poor see themselves not as an exploited proletariat, but as temporarily embarrassed millionaires”

Those at the top receive more than they produce, so why complain (however they do get defensive anytime someone proposes a common sense regulation)? Those in the middle earn roughly what they produce, and have a reasonable belief they will make it to the top; you don’t want to regulate what you one day aspire to be! Those at the bottom–well fuck em’ they’re lazy drug users!

How have those at the top succeeded at winning the PR war on income inequality? The best explanation I have heard comes from Matt Taibbi’s book “Griftopia”. In this book, he tells a story of local level governance which is overrun by regulations (he uses an example of a bureaucracy ramming affordable housing down a communities throat). Knowing that middle-class people experience over-regulation at the local level, those at the top seize on this “big-government” narrative to drum up support for financial deregulation; they create a narrative of “the poor banker trying to earn a buck”.

This narrative resonates with the middle-class worker who experiences the aforementioned local government over-regulation. It is reinforced by media commentary, which is often a pawn of those at the top (another tool, like political clout, enabled by surplus wealth). Furthermore, this narrative also vilifies financial regulation as a something which stifles economic growth / cost jobs / lead to higher consumer finance costs (and in this economy, we simply cant afford it!), even though economic theory and common sense suggest that inequality stifles consumption, job creation, and economic growth.

Of course this is a false equality; federal (and international) financial sector regulation and local / state government regulation are unrelated (local governance may well be over-regulated in some instances, but the financial sector is undeniably under-regulated). But unless you have studied the way the government works (which most people haven’t), you have no idea you are being fed horseshit; you hear the word “regulation” and cry bloody murder. Because local governance is often intervening on behalf of lower class citizens, this creates a rift between the middle and lower class, while the real culprits are laughing all the way to the bank (quite literally–they tend to work at banks).

—

If this sounds like class warfare, that’s because America is experiencing class warfare.

This post relied heavily on generalizations, there are undoubtedly people in each class of society who do not fit into these generalizations. But in general these descriptions hold (that’s why they’re called generalizations).

This post focused on America; globally the inequality problem is much worse. According to a just-released Oxfam report, the richest 85 people in the world control the same amount of wealth as the bottom 3.5 billion (that’s nearly half the global population!). Recently, UNDP chief Helen Clark spoke about the link between inequality, poverty, and standard of living. Least developed countries experience different problems (extreme poverty, authoritarian / incompetent governance, lack of access to credit, armed conflict, etc.), but these problems manifest themselves in similar ways (poverty, inequality, power imbalances).

The whole world must confront and stop enabling “wealth addiction”, if we hope to realize sustainable human development in the 21st century. We must try, through regulation, taxation, and incentives, to restore the productivity-to-earnings relationship. As inequality becomes more of a “mainstream” issue (it has recently been emphasized by, among others, Barack Obama and Pope John Francis), we can expect to see a larger portion of society begin to champion pro-poor causes.